INVESTMENT INCENTIVES AND PREFERENCES

(BP Portal) - Policies and list of projects calling for investment in Binh Phuoc province

A. PRIORITIES ON LAND

I. EXEMPTION OF LAND LEASING FEE, WATER SURFACE LEASING FEE

1. The projects with the land leasing fee and water surface leasing fee exempted for the whole leasing period:

a. The investment projects in the sectors with special investment priorities invested in the locations with special socio-economic difficulties.

b. The projects using the land to construct the accommodation for the workers at the industrial parks according to the projects approved by the competent authorities, the project owners are not permitted to include the land leasing fee into the house leasing fee.

c. Land used for implementing the protective forestation projects.

d. The projects using the land for constructing the science research facilities of the science and technology enterprises if meeting the relevant conditions (if any) including the land for constructing the laboratory, the land for constructing the experimenting facilities, the land for constructing the testing production facilities.

e. The projects invested by the agricultural cooperative using the land for constructing the office of the cooperative, drying yard, warehouse; constructing the service facilities directly serving the agricultural, forestry production and aquaculture activities.

f. Land used for constructing the maintenance, repair workshop, parking area (including the ticket area, operation management area, public areas) serving for the public passenger transportation activities according to the regulations of the law on-road transportation.

g. Land used for constructing the water supply works including water exploitation and treatment works, pipeline and the works on the water supply pipeline network, and the works supporting for management and operation of the water supply systems (administration office, management house, workshop, material and equipment warehouses).

Land used for constructing the infrastructure shared in the industrial park, industrial complex, processing and export areas according to the master plan approved by the competent authority

I. EXEMPTION OF LAND LEASING FEE, WATER SURFACE LEASING FEE

1. The projects with the land leasing fee and water surface leasing fee exempted for the whole leasing period:

a. The investment projects in the sectors with special investment priorities invested in the locations with special socio-economic difficulties.

b. The projects using the land to construct the accommodation for the workers at the industrial parks according to the projects approved by the competent authorities, the project owners are not permitted to include the land leasing fee into the house leasing fee.

c. Land used for implementing the protective forestation projects.

d. The projects using the land for constructing the science research facilities of the science and technology enterprises if meeting the relevant conditions (if any) including the land for constructing the laboratory, the land for constructing the experimenting facilities, the land for constructing the testing production facilities.

e. The projects invested by the agricultural cooperative using the land for constructing the office of the cooperative, drying yard, warehouse; constructing the service facilities directly serving the agricultural, forestry production and aquaculture activities.

f. Land used for constructing the maintenance, repair workshop, parking area (including the ticket area, operation management area, public areas) serving for the public passenger transportation activities according to the regulations of the law on-road transportation.

g. Land used for constructing the water supply works including water exploitation and treatment works, pipeline and the works on the water supply pipeline network, and the works supporting for management and operation of the water supply systems (administration office, management house, workshop, material and equipment warehouses).

Land used for constructing the infrastructure shared in the industrial park, industrial complex, processing and export areas according to the master plan approved by the competent authority

2. Exemption of the land leasing fee with term:

a. Exemption of the land leasing fee and water surface leasing fee during the basic construction duration:

- The investors will have the land leasing fee and water surface leasing fee exempted during the basic construction duration according to the project approved by the competent authority but not exceeding 03 years since the effective date of the decision on leasing land, leasing water surface.

- In case the land lease uses the land for the agricultural production purposes (planting perennial trees) according to the project approved by the competent authority, then the basic construction duration of the tree garden will have the land leasing fee exempted for each kind of tree according to the technical procedures for planting and caring perennial trees issued by the Ministry of Agriculture and Rural Development.

- The exemption of land leasing fee, water surface leasing fee during the basic construction duration is implemented according to the project which is closely linked to the cases that the State newly leases the land, changes from the land handing over without land use fee to leasing the land, excluding the cases invested into constructing, upgrading, expanding the business and production facilities and re-farming the tree garden on the land area which is being leased by the State.

a. Exemption of the land leasing fee and water surface leasing fee during the basic construction duration:

- The investors will have the land leasing fee and water surface leasing fee exempted during the basic construction duration according to the project approved by the competent authority but not exceeding 03 years since the effective date of the decision on leasing land, leasing water surface.

- In case the land lease uses the land for the agricultural production purposes (planting perennial trees) according to the project approved by the competent authority, then the basic construction duration of the tree garden will have the land leasing fee exempted for each kind of tree according to the technical procedures for planting and caring perennial trees issued by the Ministry of Agriculture and Rural Development.

- The exemption of land leasing fee, water surface leasing fee during the basic construction duration is implemented according to the project which is closely linked to the cases that the State newly leases the land, changes from the land handing over without land use fee to leasing the land, excluding the cases invested into constructing, upgrading, expanding the business and production facilities and re-farming the tree garden on the land area which is being leased by the State.

b. Exemption of land leasing fee, water surface leasing fee after the basic construction duration:

- Exempting for three (03) years: the project under the list of the sectors with investment priorities, for the new products and business facilities of the economic organizations which are displaced according to the plan, displaced due to environmental population.

- Exempting for seven (7) years: The investment project into the locations with the socio-economic difficulties;

- Exempting for eleven (11) years: the investment projects into the locations with especial socio-economic conditions; the investment projects into the list of sectors with special investment priorities; the project in the list of sectors with investment priorities invested in the locations with the socio-economic difficulties;

- Exempting for fifteen (15) years: The project in the list of sectors with investment priorities invested in the locations with special socio-economic difficulties; the project in the list of sectors with special investment priorities and invested in the location with the socio-economic difficulties;

- The project with the land handed over by the State with land use fee collected before July 1st, 2014 which is still receiving the priorities of land use fee exemption will continue to have the land use fee exempted for the remaining land use duration when moving to the land leasing method.

c. The contents of incentives regulated at points a, b above are not applied for mineral resource exploitation projects.

II. REDUCTION OF LAND LEASING FEE, WATER SURFACE LEASING FEE

The land leasing fee, water surface leasing fee is reduced for the following cases:

1. The cooperative that hires the land to use for building the production and business facilities will have the land leasing fee reduced 50%

2. The land, water surface hired to use for the agricultural, forestry production, aquaculture activities which suffers from the natural disaster, fire with the damage of less than 40% of the output will be considered to have the land leasing fee reduced respectively to the impact percentage; the damage of from 40% of the output or more will be considered to have the land leasing fee exempted for the year with damage.

3. The land, water surface hired to use for the production and business purposes which are not for agricultural, forestry production, aquaculture activities or not in the economic area, hi-tech industrial park which suffers from the natural disaster, fire, force majeure accident will have the land leasing, water surface leasing fee reduce 50% for the time with production, business interruption.

III.EXEMPTION OF LAND USE FEE

The enterprise, cooperative that invests themselves in constructing the social housing will have the land use fee exempted for the area handed over to implement the project, the project owner is not permitted to include the land use fee into the house leasing, selling price.

IV. LAND USE FEE EXEMPTION, REDUCTION FOR BORDER GATE ECONOMIC AREA

(according to Decision No. 72/2013/QD-TTg dated 26/11/2013 by the Prime Minister):

Investors in the economic zone, if with the land granted by the State, are entitled to exemption or reduction of land use fee as follows:

- Land use fee exempted for the projects with special investment priorities

- Reduction of 50% of land use fee to be paid to the state budget for the projects in the sectors with investment priorities

- Reduction of 30% of the land use fee to be paid to the state budget for the investment projects which do not belong to Item 1 and Item 2 above.

V. PRIORITIES ON ENTERPRISE INCOME TAX

The preferential tax rate for enterprise income tax

1. The preferential tax rate of 10% for 15 years applied to:

a. The income of the enterprise from implementing the new investment project in the locations with special socio-economic difficulties, economic area, hi-tech area;

b. The income of the enterprise from implementing the new investment project into the sectors as follows: science research and technology development; application of high technology in the list of high technologies given with the priorities for investment and development according to the Law on high technology; the investments into developing the water plants, power plants, water supply and drainage systems; bridge, road and other especially important infrastructure works decided by the Prime Minister; production of software (in the list of software meeting the procedures on software production according to the regulations of the law); production of composite materials, light construction materials, rare and valuable materials; recycle energy production, clean energy, energy from waste disposal; development of biological technology.

c. The income of the enterprise from implementing the new investment project in the environmental protection sector, including production of environmental pollution treatment equipments, environment monitoring and analyzing equipment; pollution treatment and environmental protection; collection and treatment of wastewater, emission, solid waste; recycling and reusing the solid waste.

d. Hi-tech enterprises, agricultural enterprises applying high technologies, science and Technology Enterprises;

e. The income from the enterprise from implementing the new investment project in the production sector (except the production of goods bearing special income tax, mineral exploitation) and meeting one of two criteria below:

- The project with the investment capital of 6 (six) thousand billion at the minimum, and the disbursement is carried out no more than 3 years since the date of issue of the first investment certificate according to the regulations of the law on investment and has the minimum revenue of 10 (ten) thousand billion VND per year at latest 3 years after the year with revenue;

- The project with the investment capital of 6 (six) thousand billion at the minimum, and the disbursement is carried out no more than 3 years since the date of issue of the first investment certificate according to the regulations of the law on investment and uses regularly more than 3,000 labors at latest 3 years after the year with revenue;

f. The income of the enterprise from implementing the investment project in production sector, except the project that produces the goods bearing special income tax and the project that exploits the minerals with the investment capital of 12,000 (twelve thousand) billion VND at the minimum, and uses the technology which is appraised according to the regulations of the law on high technology, the law on science and technology, and has the total registered investment capital disbursed no later than 5 (five) years since the date of getting the investment license according to the regulations of the law on investment

g. The income of the enterprise from implementing the new investment project in producing the products in the list of the supporting industry products given with the priorities for development and meeting one of the following criteria:

- The supporting industry product for the high technology according tot eh regulations of the Law on high technology;

- Supporting industry products for producing the products of such sectors as: garment-textile, leather- footwear; electronics - computing; automobile production and assembling; mechanical processing for such products that have not yet produced in the country or can be produced in the country but required to meet the technical standards of EU or equivalent up to January 1 st 2015.

The list of supporting industry products with the priorities for development will receive the tax priorities according to the regulations of the Government.

2. Preferential tax rate of 10 % during the operation applies to:

a. Income from operation of business socializing;

b. Income from publication activities of the publishing houses according to the regulations of the Publication Law;

c. Income from newspaper activities (including advertisements on newspapers) of press agencies according to the regulations of Press Law;

d. The income of the enterprise from implementing the social housing investment and trading project to sell, lease the objects regulated in Article 53 of the Housing Law;

The social house regulated in this clause is the house invested by the State or organization, individual under the construction investment economic sectors and meets the criteria on housing, house selling price, house leasing price, objects, conditions to be entitled to buy, lease the social house according to the regulations of the law on housing and the definition of income tax eligible for receiving the tax rate of 10% regulated in this Clause shall not depend on the time of signing the contract on selling, leasing the social house;

e. The income of the enterprise from planting, caring, protecting the forest; the income from planting, animal raising, aquaculture, processing agricultural and aquatic products in the locations with the socioeconomic difficulties; forestry production in the locations with the socio-economic difficulties; production, multiplication and breeding of plants and animals; investment into preserving the agricultural products after harvesting, preserving the agricultural, aquatic products and food including the investments to directly preserve the products directly or the investments for leasing the preservation services for agricultural, aquatic products and food;

f. The income proportion of the cooperative operating in agricultural, forestry activities which are not in the locations with socio-economic difficulties and locations with the special socio-economic difficulties, except the income proportion of the cooperative as regulated in clause 1 Article 4 of Decree No. 218/2013/NO-CP dated 26/12/2013 by the Government

3.The preferential tax rate of 15% applied to:

The income of the enterprise in planting, animal breeding, processing in agricultural and aquaculture sectors in the locations which are not the locations with socio-economic difficulties or the locations with special socioeconomic difficulties.

4. The tax rate of 20% for 15 years applied to:

-The income of the enterprise from implementing the new investment projects in the locations with socioeconomic difficulties.

- The income of the enterprise from implementing the new investment projects in high-ranking steel production, producing energy-saving products; producing machines, types of equipment serving for agricultural, forestry, fishery activities; producing the irrigation equipments; producing and processing foods for livestock, poultries, aquatic products; developing traditional industry;

Since January 1 st, 2016, the tax rate of 17% is applied.

5. The time for applying the preferential tax rate:

Applied continuously from the first year with the income from the new investment project; for the high technology enterprise, enterprise applying high technology, it will apply from the date of being certified as the hi-tech enterprise or the enterprise applying high technology; for the high technology application project, it will be applied from the date of being granted with the certificate of high technology application project.

VI.TAX EXEMPTION,TAX REDUCTION

1. Tax is exempted for 4 years and reduced 50% for the next 9 years for:

-The income of the enterprise implementing the new investment project in the locations with special socioeconomic difficulties, economic area, hi-tech zone;

- The newly established enterprise in the socialized sector in the locations with the socio-economic difficulties or special socio-economic difficulties.

2. The tax is exempted for 4 years and reduced 50% for the next 5 years for the newly established enterprise in the socialized sector in the locations which are not in the list of the locations with socio-economic difficulties or special socio-economic difficulties.

3. The tax is exempted for 2 years and reduced 50% for the next 4 years for:

- The income from implementing the new investment project of the enterprise specialized in planting, animal breeding, processing in the agricultural and fishery sectors in the locations which are not the locations socioeconomic difficulties or special socio-economic difficulties;

- The income of the enterprise from implementing the new investment project in the locations with socioeconomic difficulties;

- The Income of the enterprise from implementing the new investment project in high-ranking steel production, producing energy-saving products; producing machines, types of equipment serving for agricultural, forestry, fishery activities; producing the irrigation equipments; producing and processing foods for livestock, poultries, aquatic products; developing traditional industry;

- The income of the enterprise from implementing the new investment project in the industrial park.

4. The time for tax exemption, tax reduction:

Applied continuously from the first year with the income from the new investment project that receives the preferential tax; in case there is no income in the first three years, then since the first year with the revenue from the new investment project then the time for tax exemption, tax reduction is from the fourth year. The time for tax exemption, tax reduction for the high technology enterprise, agricultural enterprise applying high technology is calculated from the time of being verified as the high technology enterprise, agricultural enterprise applying high technology.

1. Tax is exempted for 4 years and reduced 50% for the next 9 years for:

-The income of the enterprise implementing the new investment project in the locations with special socioeconomic difficulties, economic area, hi-tech zone;

- The newly established enterprise in the socialized sector in the locations with the socio-economic difficulties or special socio-economic difficulties.

2. The tax is exempted for 4 years and reduced 50% for the next 5 years for the newly established enterprise in the socialized sector in the locations which are not in the list of the locations with socio-economic difficulties or special socio-economic difficulties.

3. The tax is exempted for 2 years and reduced 50% for the next 4 years for:

- The income from implementing the new investment project of the enterprise specialized in planting, animal breeding, processing in the agricultural and fishery sectors in the locations which are not the locations socioeconomic difficulties or special socio-economic difficulties;

- The income of the enterprise from implementing the new investment project in the locations with socioeconomic difficulties;

- The Income of the enterprise from implementing the new investment project in high-ranking steel production, producing energy-saving products; producing machines, types of equipment serving for agricultural, forestry, fishery activities; producing the irrigation equipments; producing and processing foods for livestock, poultries, aquatic products; developing traditional industry;

- The income of the enterprise from implementing the new investment project in the industrial park.

4. The time for tax exemption, tax reduction:

Applied continuously from the first year with the income from the new investment project that receives the preferential tax; in case there is no income in the first three years, then since the first year with the revenue from the new investment project then the time for tax exemption, tax reduction is from the fourth year. The time for tax exemption, tax reduction for the high technology enterprise, agricultural enterprise applying high technology is calculated from the time of being verified as the high technology enterprise, agricultural enterprise applying high technology.

In case, during the first tax calculation period that the new investment project of the enterprise has the production and business time to have the tax exempted, reduced of less than 12 (twelve) months, then the enterprise is entitled to choose to have the tax exempted, reduced for the new investment project right from the tax calculation period or register with the taxation agency to have the time for starting tax exemption, reduction from the next tax calculation period.

5. Preferences for expanded investment projects:

Implementing according to Item 4, Appendix V: Preferences on Corporation IncomeTax regulated at Decree No. 31/2017/NQ-HDND dated 19/7/2017 by People's Council of Binh Phuoc Province.

B. SECTORS, INDUSTRIES WITH SPECIAL INVESTMENT PREFERENCES

I. HIGH TECHNOLOGY, INFORMATION TECHNOLOGY, SUPPORTING INDUSTRY

II. AGRICULTURE

III. ENVIRONMENTAL PROTECTION, INFRASTRUCTURE CONSTRUCTION

IV. CULTURE, SOCIAL, SPORTS, HEALTH

(Implementing according to Decision No. 31/2017/NQ-HDND dated 19/7/ 2017 at the 4,h meeting of 9* Session of People's Council of Binh Phuoc Province and Resolution No. 14/2018/NQ-HDND amending and supplementing Resolution No. 31/2017/NQ-HDND regarding encouraging policies and investment incentives in Binh Phuoc province).

C. SECTORS, INDUSTRIES WITH INVESTMENT PREFERENCES

I.SCIENCE AND TECHNOLOGY, ELECTRONICS, MECHANICAL, MATERIAL PRODUCTION, INFORMATION TECHNOLOGY

II. AGRICULTURE

III. ENVIRONMENTAL PROTECTION, INFRASTRUCTURE CONSTRUCTION

IV. EDUCATION, CULTURE, SOCIAL, SPORTS, HEALTH

V. OTHER SCIENCES AND INDUSTRIES

(Implementing according to Decision No. 31/2017/NQ-HDND dated 19/7/2017, at the 4th meeting of 9* Session of People's Council of Binh Phuoc Province and Resolution No. 14/2018/NQ-HDND amending and supplementing Resolution No. 31/2017/NQ-HDND regarding encouraging policies and investment incentives in Binh Phuoc province).

VI. LIST OF LOCATIONS WITH INVESTMENT PREFERENCES

a. Extremely difficult socio-economic locations, including districts: Loc Ninh, Bu Dang, Bu Dop, Bu Gia Map, Phu Rieng.

b. Difficult socio-economic locations, including districts: Phuoc Long, Binh Long, Hon Quan, Chon Thanh, Dong Phu and Industrial Parks established according to regulations of the Government.

VII. PROCEDURES FOR HANDLING ADMINISTRATIVE PROCEDURES ON INVESTMENTS Implementing according to Appendix VII, Decree No. 31/2017/NQ-HDND dated 19/7/2017 on the policy on investment incentives and preferences in Binh Phuoc Province.

5. Preferences for expanded investment projects:

Implementing according to Item 4, Appendix V: Preferences on Corporation IncomeTax regulated at Decree No. 31/2017/NQ-HDND dated 19/7/2017 by People's Council of Binh Phuoc Province.

B. SECTORS, INDUSTRIES WITH SPECIAL INVESTMENT PREFERENCES

I. HIGH TECHNOLOGY, INFORMATION TECHNOLOGY, SUPPORTING INDUSTRY

II. AGRICULTURE

III. ENVIRONMENTAL PROTECTION, INFRASTRUCTURE CONSTRUCTION

IV. CULTURE, SOCIAL, SPORTS, HEALTH

(Implementing according to Decision No. 31/2017/NQ-HDND dated 19/7/ 2017 at the 4,h meeting of 9* Session of People's Council of Binh Phuoc Province and Resolution No. 14/2018/NQ-HDND amending and supplementing Resolution No. 31/2017/NQ-HDND regarding encouraging policies and investment incentives in Binh Phuoc province).

C. SECTORS, INDUSTRIES WITH INVESTMENT PREFERENCES

I.SCIENCE AND TECHNOLOGY, ELECTRONICS, MECHANICAL, MATERIAL PRODUCTION, INFORMATION TECHNOLOGY

II. AGRICULTURE

III. ENVIRONMENTAL PROTECTION, INFRASTRUCTURE CONSTRUCTION

IV. EDUCATION, CULTURE, SOCIAL, SPORTS, HEALTH

V. OTHER SCIENCES AND INDUSTRIES

(Implementing according to Decision No. 31/2017/NQ-HDND dated 19/7/2017, at the 4th meeting of 9* Session of People's Council of Binh Phuoc Province and Resolution No. 14/2018/NQ-HDND amending and supplementing Resolution No. 31/2017/NQ-HDND regarding encouraging policies and investment incentives in Binh Phuoc province).

VI. LIST OF LOCATIONS WITH INVESTMENT PREFERENCES

a. Extremely difficult socio-economic locations, including districts: Loc Ninh, Bu Dang, Bu Dop, Bu Gia Map, Phu Rieng.

b. Difficult socio-economic locations, including districts: Phuoc Long, Binh Long, Hon Quan, Chon Thanh, Dong Phu and Industrial Parks established according to regulations of the Government.

VII. PROCEDURES FOR HANDLING ADMINISTRATIVE PROCEDURES ON INVESTMENTS Implementing according to Appendix VII, Decree No. 31/2017/NQ-HDND dated 19/7/2017 on the policy on investment incentives and preferences in Binh Phuoc Province.

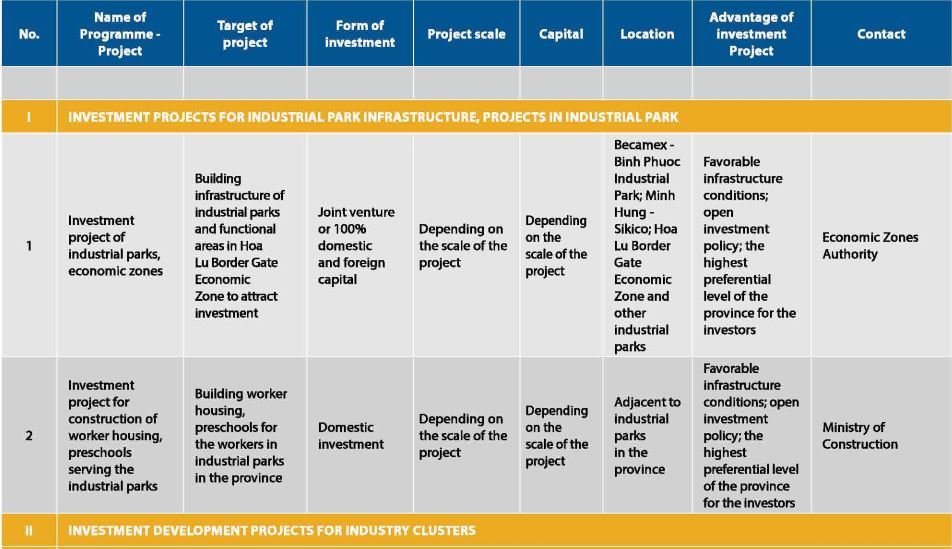

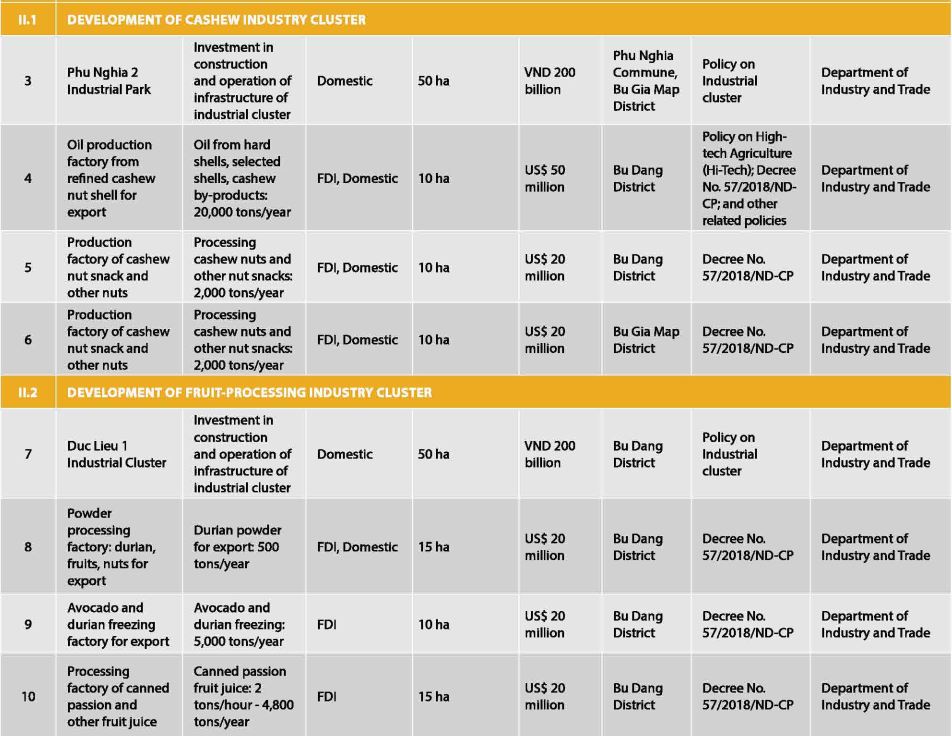

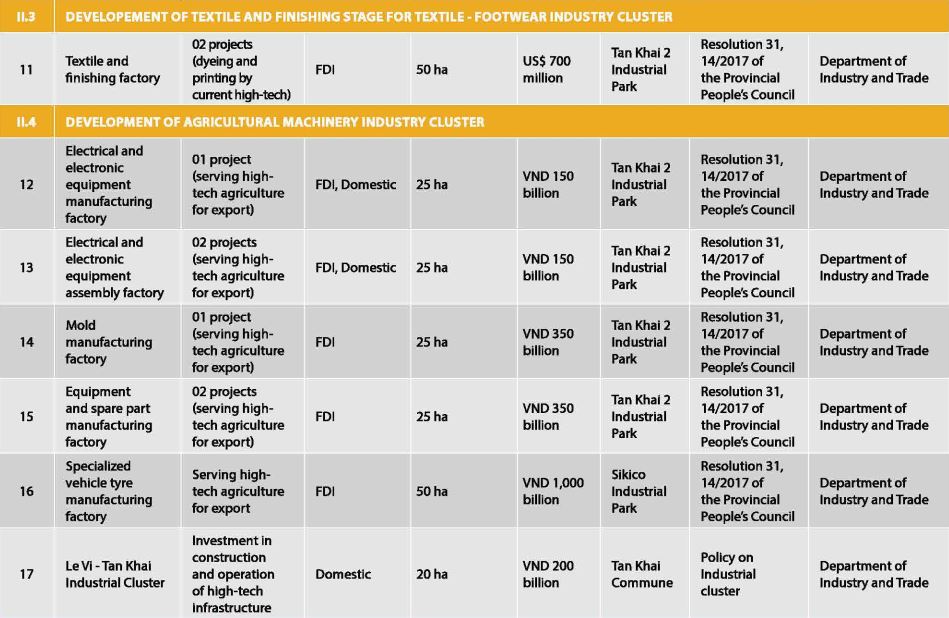

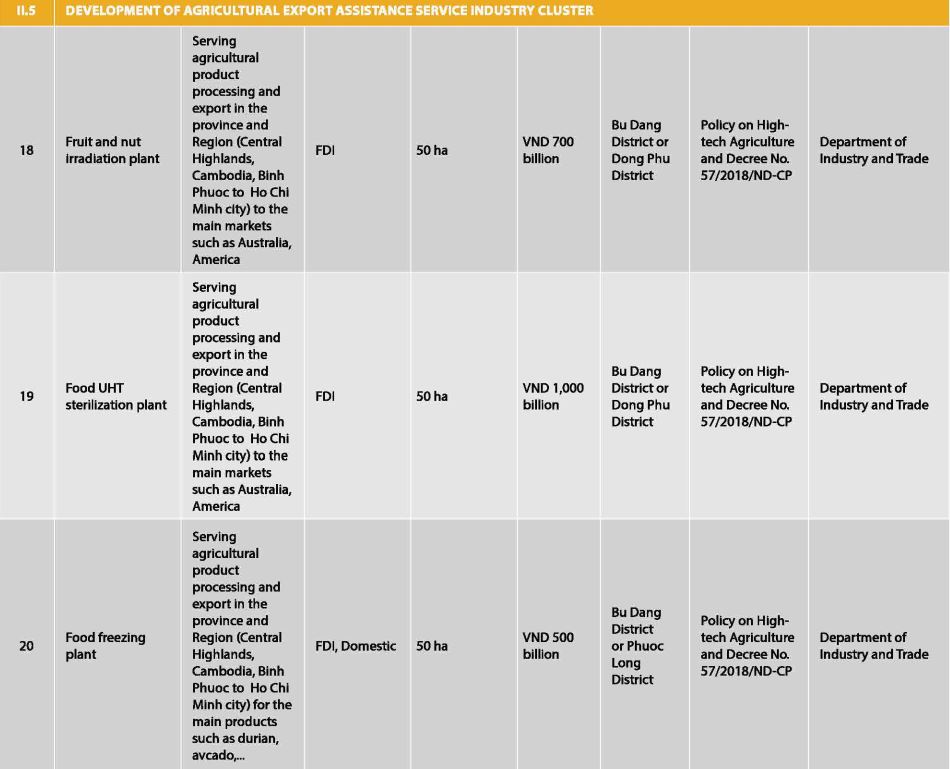

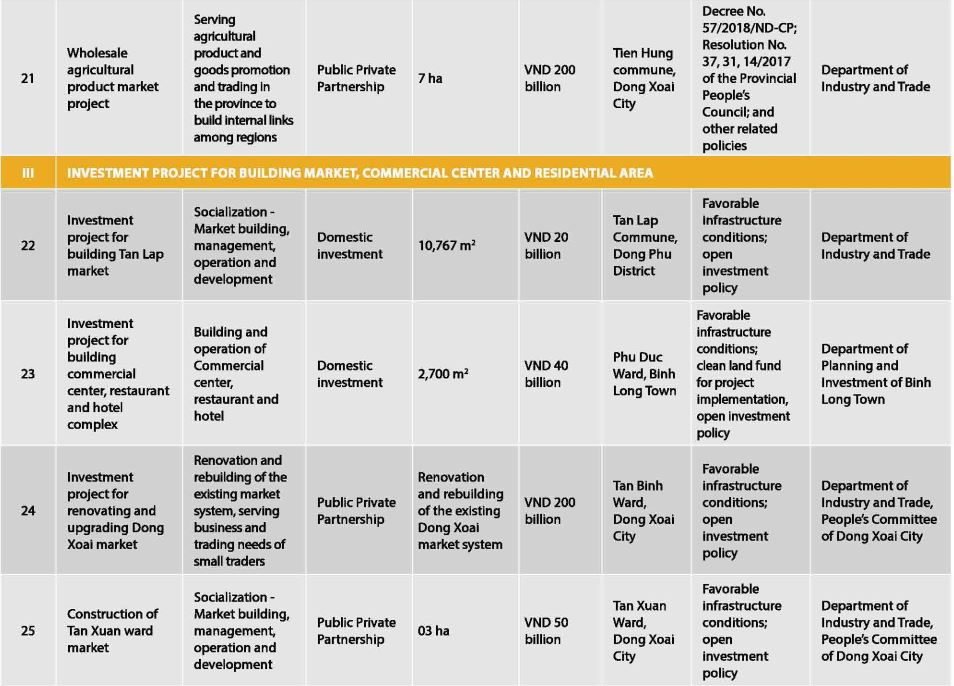

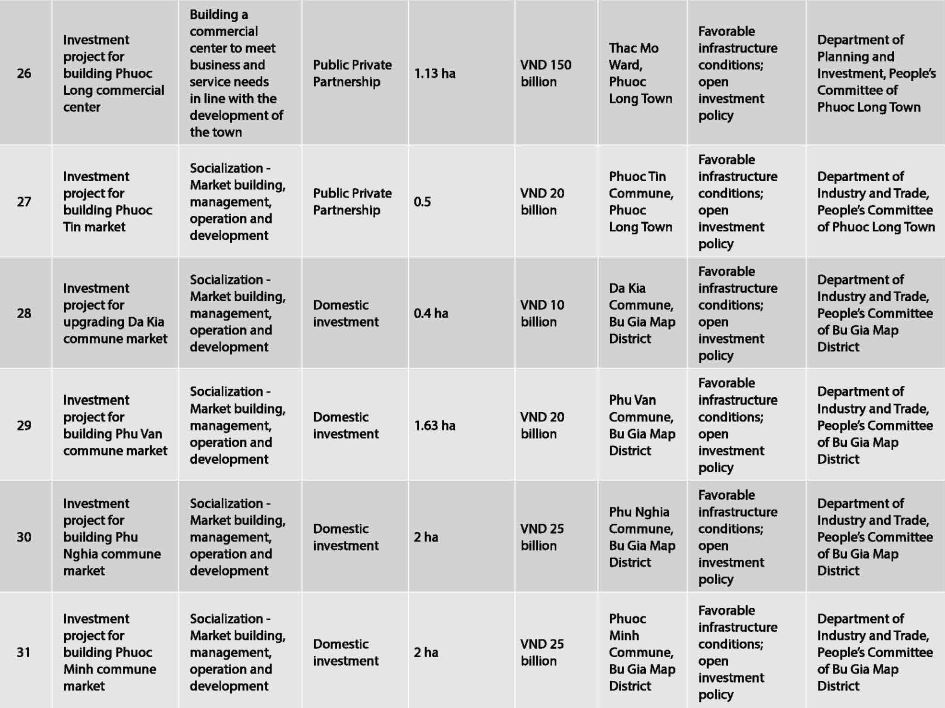

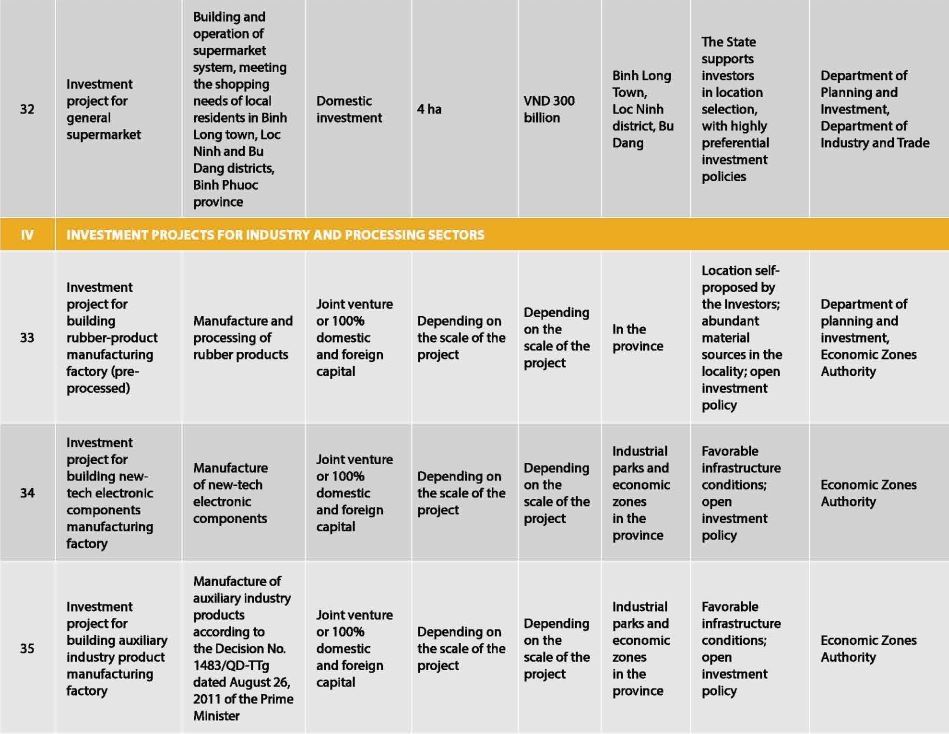

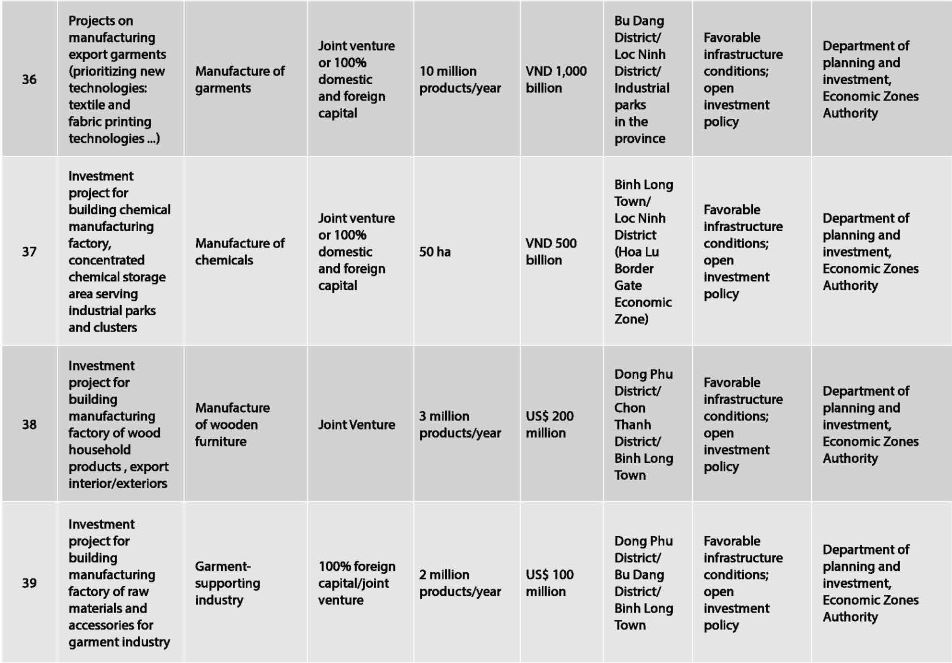

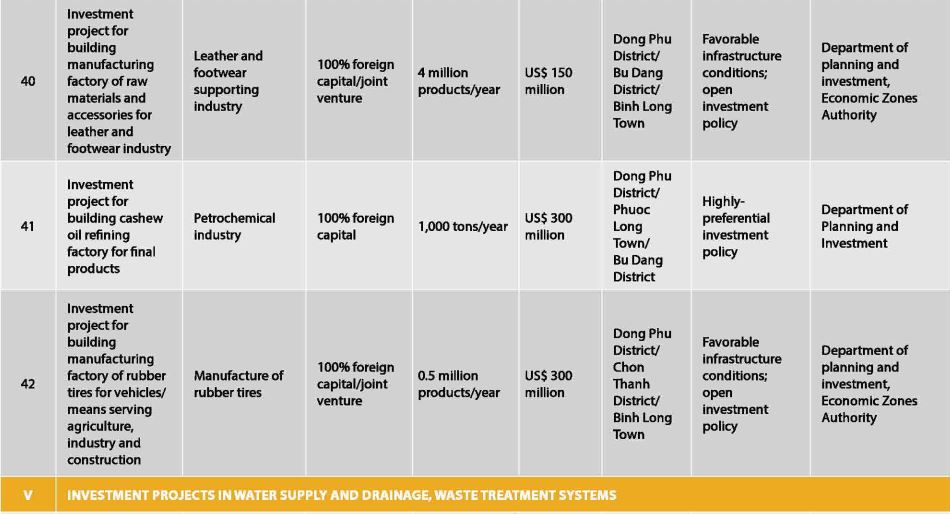

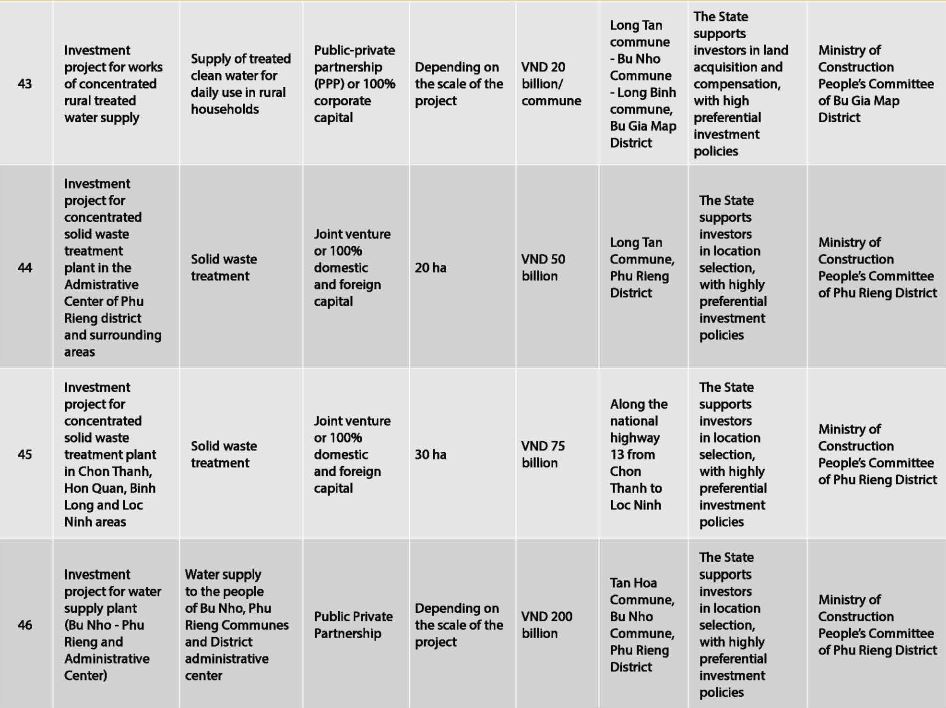

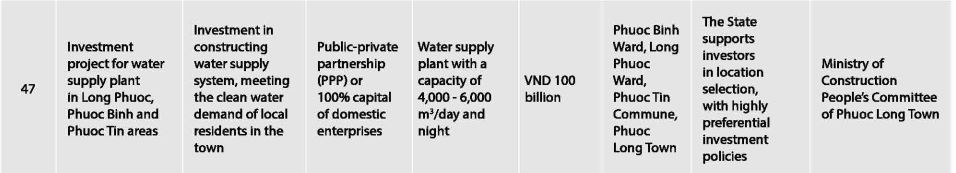

LIST OF PROJECT CALLING FOR DOMESTIC AND FOREIGN INVESTMENT IN THE PERIOD OF 2019-2025

Tác giả: T.T (BINH PHUOC PROVINCE INVESTMENT PROMOTION HANDBOOK)

ADMINISTRATIVE APARATUS

ADMINISTRATIVE APARATUS

INVESTMENT

INVESTMENT